SAP Risk Management: Navigating Risks for Business Resilience

Introduction

Businesses are struggling to manage today’s inevitable, difficult, and costly risk landscape. The old risk management strategy of managing risk in silos across separate teams, processes, or divisions cannot be able to meet the current business requirements. Effective risk management has become a significant operational and financial challenge, jeopardizing the organization’s ability to keep up with corporate growth and revolutionary projects.

This is where SAP Risk Management comes in, with a complete solution to assist organizations in identifying, assessing, and mitigating risks.

In this blog, we will look at the core features and benefits of SAP Risk Management, as well as how it can help organizations navigate the complicated risk environment with confidence.

The Importance of Risk Management

Risk management includes identifying, assessing, and mitigating potential risks to an organization’s goals, assets, and stakeholders. Successful risk management protects a company’s reputation and financial health while also facilitating strategic decision-making and long-term growth.

Risk management has never been more important in an era of growing regulatory scrutiny and global economic uncertainty. It enables businesses to:

- Proactively Address risks:

Identifying risks before they escalate enables for timely solutions, reducing possible damage.

- Ensure Compliance:

Organizations must follow a maze of rules and regulations. Risk management ensures that these standards are met.

- Improve Decision-Making:

Informed with risk assessments, executives can make strategic decisions with a thorough grasp of potential consequences.

- Safeguard Reputation:

Managing risks and preventing crises protects a company’s reputation and brand image.

- Support Financial Stability:

Effective risk management reduces financial risks and aids in the maintenance of a stable financial position.

Types of Risk Businesses Face:

- Strategic Risks –

Strategic risk refers to your organization’s reaction to these risks and possibilities. It necessitates a solid understanding of corporate strategy, the risks associated with implementing it, and their ability to respond to market developments.

- Financial risks –

Financial risk refers to a wide range of financial risks, such as commercial transactions involving corporate loans that are at risk of default. Risk is a term commonly used to describe downside risk, which relates to the uncertainty of recovery and the likelihood of financial damage.

- Operational Risks –

The people, procedures, and technology required to meet an organization’s strategic goals offer operational risks. Among these risks are the efficiency with which information technology systems work and the procedures put in place to protect private data.

- Regulatory Risks –

Regulatory risks include an organization’s compliance with corporate sustainable growth, trade, financial analysis, and other regulatory and legal obligations.

Why SAP Risk Management?

Using SAP Risk Management, you can manage all types of risks throughout your organization, encouraging collaboration and providing a consistent approach to risk management.

With this programme, you will be able to identify and analyze the risks that contribute to the value of your organization.

KRIs give ongoing visibility into emerging risk events and their potential consequences, allowing you to make responsible and defensible business decisions based on risk awareness.

When it comes to risk management, there is a propensity to create long lists of potential dangers that cover every part of the organization.

Risk management is difficult to maintain given the number and complexities involved, and most of it is unneeded. Concentrating on value and value drivers necessitates focusing on the business’s fundamental operations and processes.

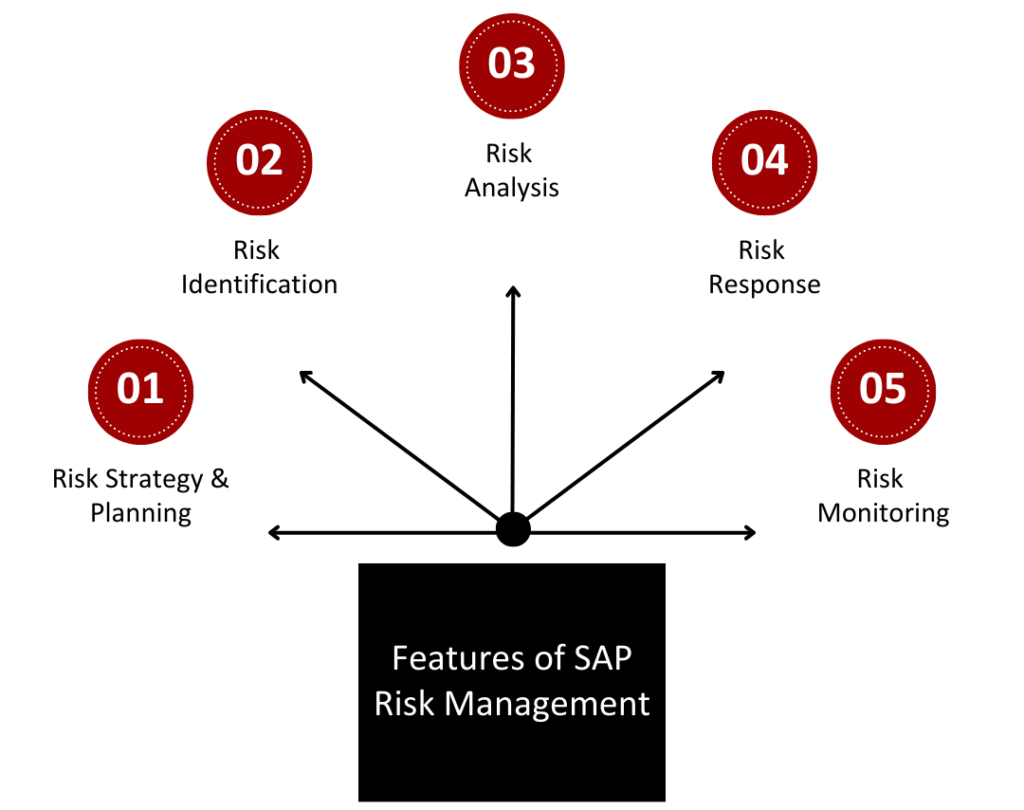

Features of SAP Risk Management:

- Risk Strategy & Planning –

Define risk-relevant business processes, develop a risk framework for your organization, and define your organization’s risk appetite, risk owners, and responsibilities. Create risk databases to structure and report on risk evaluation results, as well as establish your KRI framework for risk monitoring.

- Risk identification –

It entails documenting the potential significant sources and implications of risks, as well as establishing the relationship between risks and events. Capabilities include the capacity to define survey questions, document activities, propose dangers, and identify issues and threats.

- Risk Analysis –

Analyze risks statistically and qualitatively to determine the likelihood of occurrence and potential impact. Capabilities include conducting evaluations, developing risk scenarios, risk assessment, reaction planning, and recording responses and improvement plans.

- Risk Response –

The purpose of risk response is to make decisions about which risks should be managed and what priority should be allocated to them based on risk assessments. The risk response process comprises comparing the degree of risk revealed during the analytical phase to risk criteria established when the context was considered. The goals of the organization, as well as the scope for business objectives, should be assessed.

- Risk Monitoring –

Analyze and report on the risk condition in your organization. Be sure to keep an eye on thresholds as well as the effectiveness of risk management strategies.

Benefits of Risk Management:

- Gain Insight Into Value-Adding Risks:

SAP Risk Management enables organizations to identify and manage risks as opportunities rather than threats. Businesses can obtain a competitive edge by proactively exploiting risks that can provide value. This method switches the focus from risk avoidance to risk optimisation, where measured risks can result in innovation, growth, and market dominance.

- Optimize Risks and Controls to Meet Strategic Goals:

One of SAP Risk Management’s most notable advantages is its ability to link risk management with an organization’s strategic business goals. Businesses can ensure that their risk management efforts are in sync with their larger strategic objectives by employing software to examine how risks and controls can be optimized.

- Scan the horizon for risks and opportunities:

Being able to scan the horizon for developing risks and possibilities is a significant advantage in a continuously changing corporate world. SAP Risk Management helps with this by giving the tools and data needed to identify possible hazards and capitalize on emerging trends.

This proactive approach to risk management enables organizations to remain ahead of the competition and capitalize on possibilities that others may overlook.

- Monitor Risk Levels and Key Risk Indicators Continuously:

Continuous monitoring is a critical component of contemporary risk management. Organizations can utilize SAP Risk Management to track risk levels, risk drivers, and important risk indicators in real time.

This ongoing attention allows firms to respond quickly to shifting risk circumstances while still maintaining a clear awareness of their risk.

- Preserve Value by Minimizing Needless Loss:

A key goal of risk management is to identify and mitigate risks that can result in unacceptable losses. SAP Risk Management aids organizations in identifying high-impact risks and taking the appropriate actions to mitigate or eliminate them.

By doing so, businesses preserve value and protect themselves from potentially disastrous financial, operational, or reputational losses.

Last Thought

In an era where risk can come from a variety of causes, such as economic swings, cybersecurity attacks, and supply chain interruptions, SAP Risk Management is a vital tool for organizations seeking to prosper in the face of unpredictability.

Navigating unpredictability in business is a difficult undertaking, but SAP Risk Management can be a valuable friend in this endeavor. This platform enables organizations to successfully identify, analyze, and reduce risks by providing a systematic, data-driven approach to risk management.

For any queries or the need for expert guidance, feel free to reach out to KaarTech, guiding you towards resilient and secure business operations.

FAQ’s

What is SAP risk management?

SAP Risk Management in GRC is used to manage risk-adjusted corporate performance, allowing an organization to maximize efficiency, effectiveness, and visibility across risk programs.

What are the different risk types in SAP?

These different types of risk include SAP GRC Risk Management, operational risk, strategic risk, compliance risk, and financial risk.

What are the advantages of using SAP risk management?

They include acquiring insight into value-added risks, optimizing risks and controls to fulfill strategic goals, and regularly monitoring risk levels and key risk indicators while scanning the horizon for hazards and opportunities.